is there real estate transfer tax in florida

The state transfer tax rate for properties 800000 or less is 075. What are transfer taxes in Florida.

For example say when you sold your home the just value for property taxes was 150000 and the assessed value was 100000.

. For the purposes of determining. The Florida documentary stamp. The documentary stamp tax on a 150000 home would equal 105000.

There is a doc stamp of 350 per thousand and an intangible tax of 250 per. In Miami-Dade County the tax rate is 060 per 100 for single family residences with a 045 surtax on each 100. Miami-Dades tax rate is 60.

You can bring 50000 with you. There is a doc stamp of 350 per thousand and an intangible tax of 250 per. In Miami-Dade County the tax rate is 060 per 100 for single family residences with a 045 surtax on each 100 added for other types of property.

The Director Real Estate Transfer Tax will play an instrumental role in the development of the Real Estate Transfer Tax section of the Property Tax Consulting Practice. The tax rate for documents that transfer an interest in real property is. 500 number of taxable units representing the interest transferred for consideration x 70 35000 tax due.

Florida Documentary Stamp Tax Guide. The rate is 07 percent in most of the state but Miami-Dade County imposes a surtax making the overall rate 105 percent 06 percent in Miami Dade on single family. The documentary stamp tax on a 150000 home would equal 105000.

The Florida documentary stamp tax is a real estate transfer tax. The tax rate for documents that transfer an interest in real property is 70 per 100 or portion thereof of the total consideration paid or to be paid for the transfer. Homestead Exemption Save Our Homes Assessment Limitation and Portability Transfer When someone owns property and makes it his or her permanent residence or the permanent.

The documentary stamp tax is usually paid to the county clerk or recorder when the deed is recorded. Although it is a negotiable term purchase and sale contracts usually call for stamp taxes incurred on the transfer of the real property to be paid by the seller in the transaction and the rate of the. But if you do make money from renting or when you sell your property there will be federal taxes.

The transfer tax in Florida is levied at 70 cents for each 100 of consideration for most recorded documents including deeds of conveyance. For example if a property is purchased for 200000 first divide the sales price by 100 then multiply by 70 for a total of 1400 for documentary tax stamps. ABC LLC purchased property in Duval County for.

For portions of a propertys sale price from 800000 to 25 million the state tax rate is 125 while portions of the sale. 70 per 100 or portion thereof of the total consideration paid or. But if you do make money from renting or when you sell your property there will be federal taxes.

What Are Transfer Taxes Mansion Global

Florida Real Estate Law And Practice Explained All Florida School Of Real Estate Florida Real Estate Mastery Kemper Pamela S Raney Heather L Kemper Jeffrey V 9781535442503 Amazon Com Books

How Much Does It Cost To Sell A House Zillow

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

Real Estate Transfer Tax Ny State Propertyshark Com

Calculating State Transfer Taxes In Florida Florida Real Estate Exam Math Tutorial Youtube

Florida Property Tax H R Block

Vehicle Sales Purchases Orange County Tax Collector

Illinois Tod Deed Form Get A Transfer On Death Deed Online

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

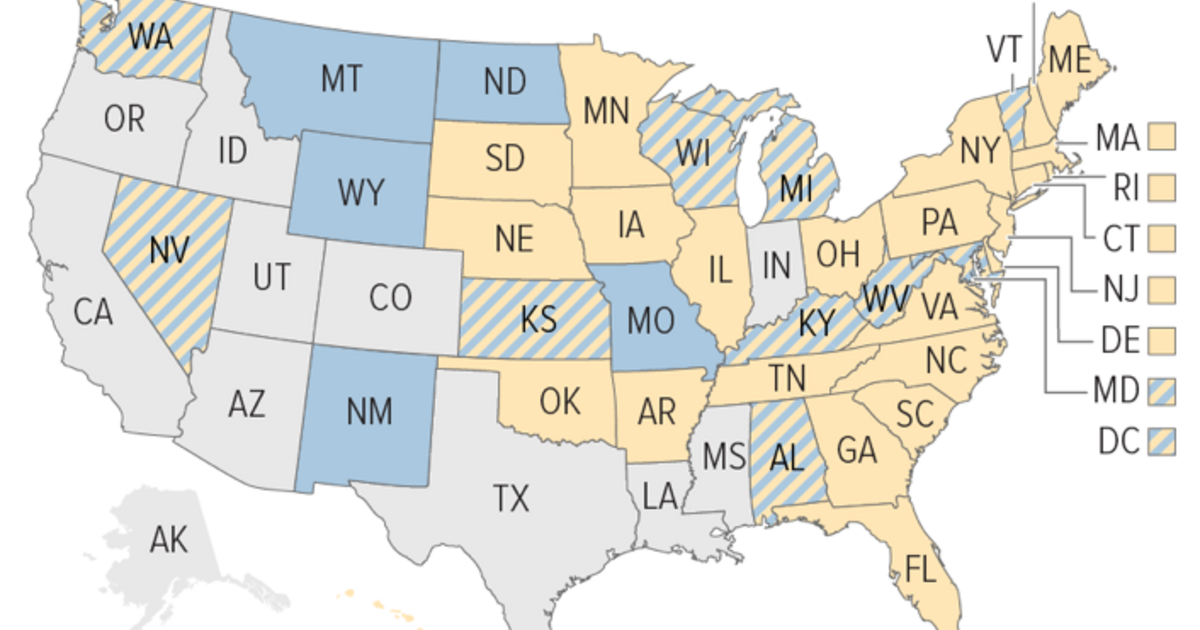

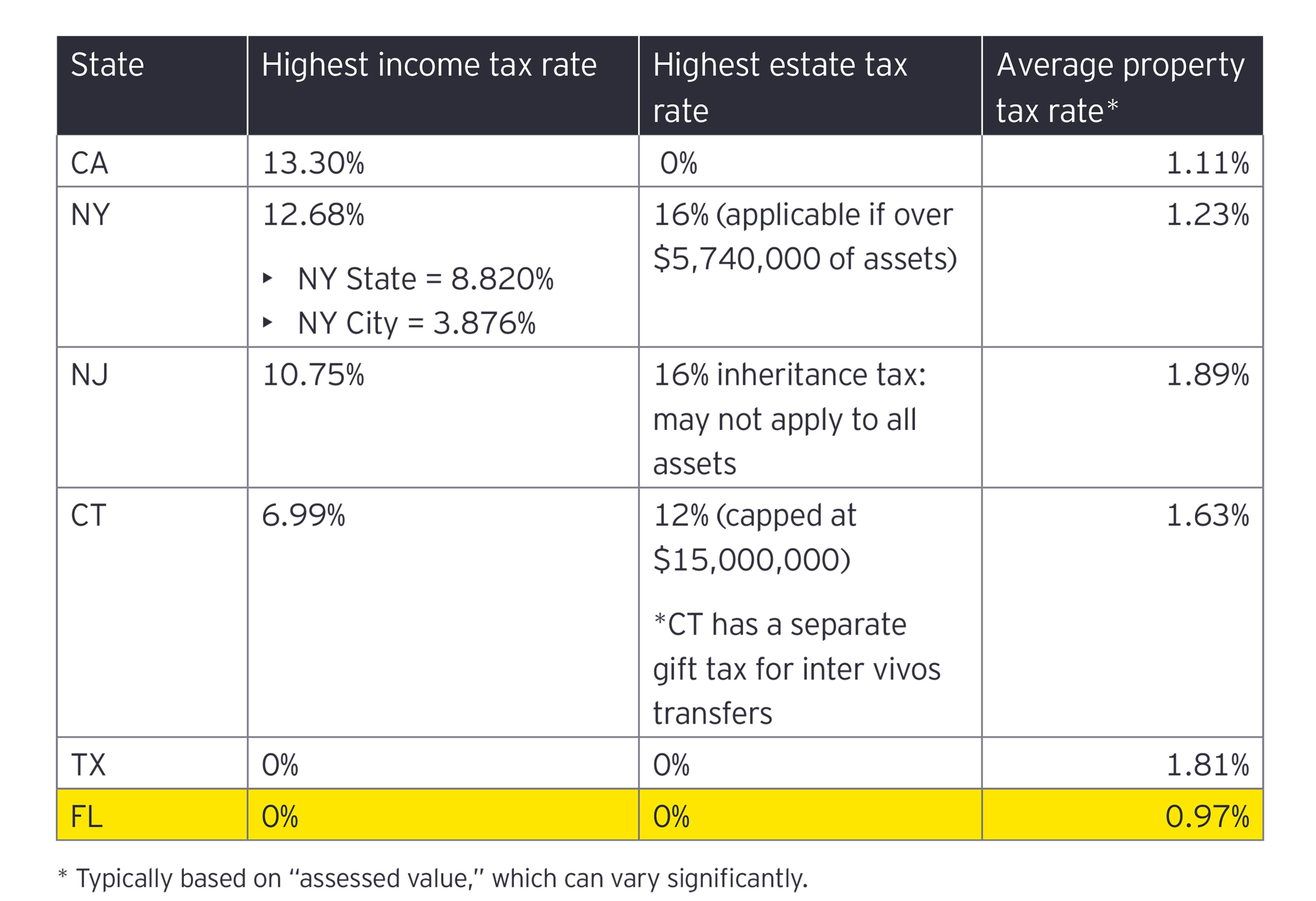

Tax Considerations When Moving To Florida Ey Us

/arc-anglerfish-arc2-prod-pmn.s3.amazonaws.com/public/URGPECSXRNDTNFO3IH6EIDFN64.jpg)

Philly Misses Full Bounty Of Shops At Schmidts Sale As Transfer Tax Shortfalls Persist

Transfer Tax And Documentary Stamp Tax Florida

What Is The Florida Documentary Stamp Tax

Free Real Estate Purchase Agreement Rocket Lawyer

Transfer Tax Calculator 2022 For All 50 States

Lady Bird Deed Getting A Lady Bird Deed Pros Cons Taxes Forms